Trade derivatives on stocks and indices

Profit from price differences on 150 instrumentsIndex trading: the benefit of an all-in-one solution

When thinking about the stock market, people usually picture buying or selling the stocks of particular companies. The market price of such stocks can experience significant ups and downs on the news related to this company or on certain reports, either bringing profits or losses to involved traders, depending on their event forecast.

But the retail part of this market is not about owning shares in an industrial giant; it’s about earning money on these stocks’ market fluctuations with the lowest risks possible. Stock market indices express the average price movement of a bundle of stocks; they never bear the risks of a single company. These indices are easier to predict, and their volatility level is higher. Traders can track market insights directly via our website to be fully informed about indices’ possible price adjustments.

Your market of opportunities to build a fortune

The stock market is extremely news-sensitive. Whenever an important event happens somewhere in the world, or whenever a great new product blows up the consumer market, this immediately affects the related market or stock market index.

For instance, when Emmanuel Macron, the 25th president of France, was elected in 2017, France’s CAC index grew by 4%. Traders were able to benefit from simply knowing this fact. And with STAR NET FX, you can trade derivatives on this index via the MT5 platform.

In 2016, Trump’s election brought quite the opposite effect when the Dow’s index fell by 900 points right after the big news. It was an excellent opportunity for a big win for traders practising short selling. STAR NET FX has this index tradable on both MT4 and MT5 platforms.

Your access to retail indices and stock trading via derivatives

Classical investing in successful stock indices is attractive and requires patience to wait for significant returns, which can take several years. However, to profit from your investment, you need to invest a significant amount of money. Traders in the retail part of the market usually choose not to enter into trades of such volume and wait for possibly modest returns. But that doesn’t mean that you can’t benefit from stock price movements.

The STAR NET FX Trading platform offers access to stock index trading (a portfolio of shares issued by different companies or industries) through derivatives, which offer the opportunity to gain from price fluctuations on the most popular indices in minutes, rather than years.

An attractive alternative to traditional stock trading

Online stock trading with derivatives brings huge advantages to traders. Trading derivatives on stocks eliminates the restrictions associated with shorting, which usually require traditional stock traders to invest in the instrument before selling short, or there could be different margin requirements for short and long positions. Derivatives also offer additional benefits:

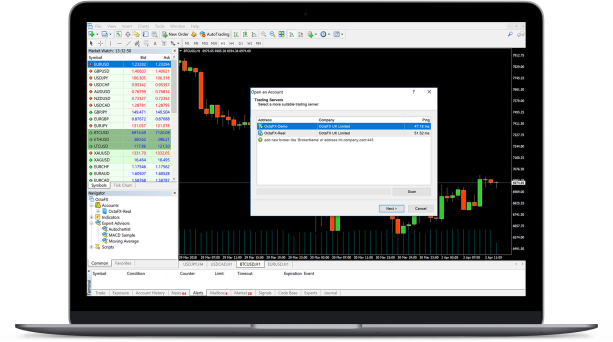

Robust platforms

Online stock trading platforms allow for automating trading with robots, which reduces guessing to minimum and removes factors of emotions and human errors.

Extended hours

Traders can even set up trades when the markets are closed, which allows them to react promptly to corporate announcements and news even before the opening of the next sessions.

Best trading tools and applications

Through the wide range of technical indicators available on MT4/MT5, traders can make well-informed stock trading decisions.

Platform accessibility

Technologies stepped in to make these trading platforms robust and secure and available on smartphones, tablets, laptops, and desktops. More people can access stock trading with greater ease and monitor stock price movements on the go.

No paper documents

This means rapid transactions with simpler setup and execution of trades.

Profit on index fluctuations through derivatives

Since stock indices are not physical assets, they can be traded via products that reflect their price movements via the STAR NET FX derivatives trading platform. Derivatives on stocks and on indices enable trading assets without actually owning them. The price of a derivative reflects the price of the underlying asset. Essentially, a derivative is a contract between a trader and a spread-betting company. Derivatives on indices cover all the major markets around the world.

Indices trading with the STAR NET FX demo account

Before trading with your real money, you can practise with our demo accounts. Derivatives on stocks are tradable on the MetaTrader 4 or MetaTrader 5 platforms. The demo account works like a real one and uses real market data, but you do not need to deposit your money. All profit or loss will also be virtual.

We recommend switching to real accounts after practising different trading strategies and techniques and getting steady profitable results.